Co-authored by Joshua Uzu

This post includes data from Forisk’s North American Timberland Transactions Database and research from the Q2 2025 Forisk Research Quarterly.

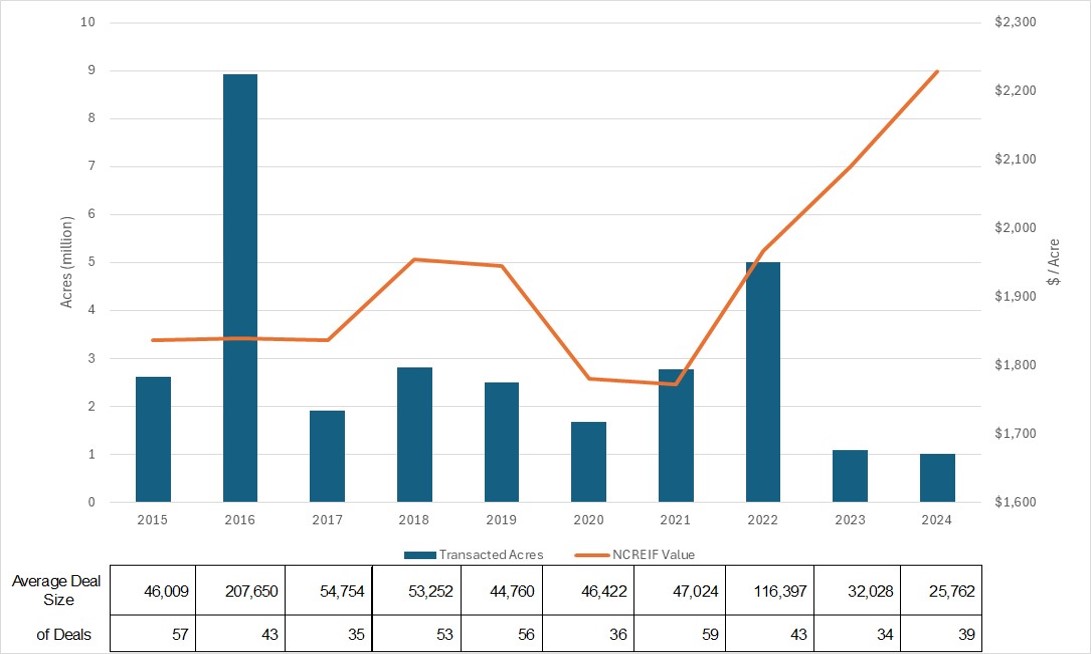

As noted in previous updates, 2023 and 2024 were below average years for timberland transaction volume, averaging just over 1.0 million acres per year. Over the last 10 years, the average was closer to 3.0 million acres annually. Through the first quarter of 2025, Forisk tracked 7 transactions totaling 99 thousand acres, which trends well below historic levels.

The availability of transaction data can lag and we routinely update our database with information on deals that closed several quarters prior, so the 99 thousand acres simply provides a snapshot of shareable deals at this time. Regardless, it does provide a reading on the current state of the market: tepid.

Looking back 10 years, roughly 20% of transactions occurred in the first quarter of each year (compared to ~40% in the fourth quarter). If 2025 were to follow this pattern, transacted timberlands would total about 500 thousand acres, which would represent an historically low volume. With the current economic and political uncertainty, along with rising interest rates, headwinds are strong. And as noted in previous posts, valuations have increased rapidly in recent years, encouraging investors to sharpen their pencils on available deals.

Weyerhaeuser recently announced the acquisition of 117 thousand acres in North Carolina and Virginia for $375 million or ~$3,200/acre. The expected closing is in Q3. While this deal will boost the total year-to-date volume, it will likely push valuations higher as well. Additionally, this transaction marks the conclusion of Weyerhaeuser’s plan to acquire $1 billion in timberland assets, announced in 2021.

Where do we go from here? With deal announcements being sparse and uncertainty in the broader market, 2025 is looking like another slow year. But things can change quickly if interests rate stabilize or other economic indicators improve. At that point, markets could shake loose additional timberland packages.