Income from livestock produce holds steady at $40 billion for season 2025-26 as world demand gets a taste for Aussie beef

Local producers are coming off record highs for their produce last season, 2024-25, and while current forecasts are slightly more cautious for the 2025-26 season, factors at play include continuing strong world demand for meat, including our own domestic market.

With demand running strongly, expect to see price rises as our local production struggles to keep the shelves full.

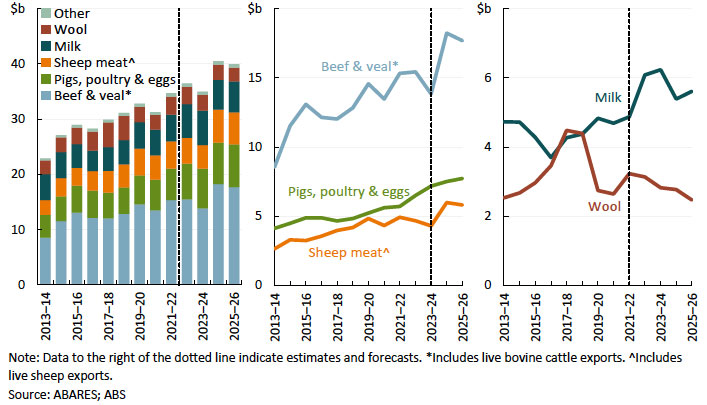

The livestock segment is an important factor in overall farm income expected for the 2025-26 season, contributing $40 billion of the predicted $90.7 billion.

Overall income is a slight drop from the $92 billion raked in last year, mainly due to an expected weakening of crop production, due to early season dry conditions. A situation that could improve drastically if timely rainfall were to eventuate.

The main factor affecting livestock produce value at this stage is the lower stock volumes available, down an estimated 3.1% on last year. This follows the sustained elevated turn-off by producers in recent years to build their flock.

The reduced livestock available for retail sale is forecast to reduce income by $0.5 billion but does not take into account the possibility of a steep price increase for producers, as retailers bid higher for a diminished volume.

Falling production volumes, strong global demand and robust restock demand in northern parts of the country are expected to result in a minimum rise of 5.1%.

By segment, the fall in supply will come from lower beef, veal and live cattle, down $0.6 billion, and sheepmeat and live sheepvalues down by $0.2 billion. All are driven by lower availability due to turn-off rates.

Wool producers have been warned of a possible lower product value, down $0.3 billion, with a double whammy of an expected reduction in the price received and production volumes.

By contrast, higher pig and poultry meat and eggs, up $0.2 billion and milk up $0.2 billion, are partly offsetting the overall estimated fall. Higher milk production values reflect higher farmgate milk prices, which remain marginally above the real 10-year average to 2024-25.

Consumers will be affected the most

Livestock producers are sitting on a prospective goldmine with prices expected to rise for most livestock commodities in 2025-26, with increased saleyard demand currently in play.

Average cattle saleyard prices are forecast to rise by 5% to 639 cents/kilogram of carcase weight, from an estimated 606 cents/kilogram in 2024-25.

With rising saleyard prices reflecting strong domestic processor demand, in response to elevated global demand for red meat, as reflected in high export prices.

A forecast fall in cattle supply to supply saleyards in 2025-26, following elevated levels in 2024-25, is expected to ensure increased buyer competition and put upward pressure on prices.

Strong restock demand from cattle producers in Queensland and northern New South Wales to withhold produce is supplemented in a small way by graziers in flood-affected regions where pasture growth has benefited from above-average Autumn rainfall.

But by contrast, large areas of southern Australia have experienced low pasture growth. Graziers in affected regions are expected to continue destocking or increase reliance on supplemental feed to maintain herds unless conditions improve.

Despite the rise, average saleyard prices are expected to remain below the peaks in season 2021-22 and 5% below the 10-year average in real terms.

Lamb and sheep saleyard prices are forecast to rise in given strong saleyard demand from both restockers and processors.

In addition, expected tightening supply of lamb and sheep to saleyards, due to successive years of high turn-off, is also placing upward pressure on prices with average lamb saleyard prices forecast to rise by 4% to 841 cents/kilogram of carcase weight, up from the 809 cents/kilogram in 2024-25.

The early 2025-26 forecast is 3% above the 10-year average in real terms.

Average mutton saleyard prices are forecast to rise by 10% to 441 cents/kilogram of carcase weight, up from 401 cents/kilogram in 2024-25. The 2025-26 forecast is 17% below the 10-year average in real terms.

Poultry and pig meat prices are forecast to remain relatively steady at 270 cents/kilogram and 420 cents/kilogram of carcase weight, respectively, as rising domestic demand offsets increased production.

Rising domestic demand reflects consumer substitution towards poultry and pork, given relatively higher prices for beef and sheep meat, and ongoing cost-of-living pressures.

Pig meat prices are forecast to remain above the 10-year average in real terms due to continued strong processor demand to secure stock to satisfy domestic demand, with pig meat imports forecast to remain lower than the 10-year average.

The farmgate milk price is forecast to rise by 5% to 68.5 cents/litre, approximately $8.90 per kilogram of milk solids, supported by higher processor competition driven by lower domestic milk production.

Reduced milk production is being driven by both dry conditions in key southern regions and the longer-term decline in dairy herds. While the forecast farmgate milk price is down from the historic highs in 2022-23, the 2025-26 price is forecast to be 2% above the 10-year average in real terms.

Stock levels under the most pressure

With demand so strong, farmers are under pressure to keep stock levels available to satisfy buyer demand.

Beef and veal production volumes are forecast to fall by 9% to 2.5 million tonnes of carcase weight, reflecting lower slaughter volumes.

Despite a forecast decline, production is expected to be 12% higher than the 10-year average, given high average cattle weights and robust demand keep turn-off rates elevated.

Lower domestic beef production is expected to see beef and veal export volumes fall by 11% in season 2025-26.

The beef cattle herd is forecast to remain relatively steady in 2025-26, up 0.7% at 27.3 million head by 30 June, on par with the 10-year average.

Improved seasonal conditions in Queensland is leading to higher female cattle retention and is expected to offset elevated cattle turn-off across southern parts of the country.

Queensland producers are a vital cog in the wheel as they account for an estimated 45% of the total cattle herd in 2022-23, according to the latest ABS data, with the Northern Territory accounting for an additional 6%.

Sheep meat production volumes are forecast to decline by 7% to 867 thousand tonnes of carcase weight, driven by reduced slaughter rates.

Lamb production is forecast to decline by 8% as a result of elevated adult sheep sales in 2024-25 reducing the total breeding flock.

Well below average rainfall and pasture growth across much of south-eastern Australia in 2024-25 means that producers are heading into 2025–26 with poor pasture availability.

This is expected to reduce lambing rates and the ability for producers to finish lambs to meet prime market specifications in some regions if timely rain does not eventuate.

Mutton production is forecast to decline by 5%, however, the proportion of mutton processed as a share of total sheep meat remains elevated, with the quarterly adult sheep kill at over two million head for 10 consecutive quarters.

In March 2025, adult sheep accounted for 44% of the total sheep and lamb slaughter, well above the 10-year average by 36%.

The total sheep flock is forecast to decline by 2% to 64.8 million head in 2025-26 due to increased turn-off of older sheep and lower lamb retention.

Dry conditions in 2024-25 in the main sheep-producing states of New South Wales, with 39% of the national sheep flock in 2021-22, Victoria 21%, and South Australia 15%, will negatively impact lamb marking rates.

Sustained processing demand and high saleyard prices are also keeping turn-off elevated.

In particular, offsetting the decline in sheep numbers is part of forecast improvements in climatic conditions in Western Australia and the increasing influence of sheep meat breeds in the flock, leading to higher lambing rates per ewe.

Export value of livestock over $71 billion

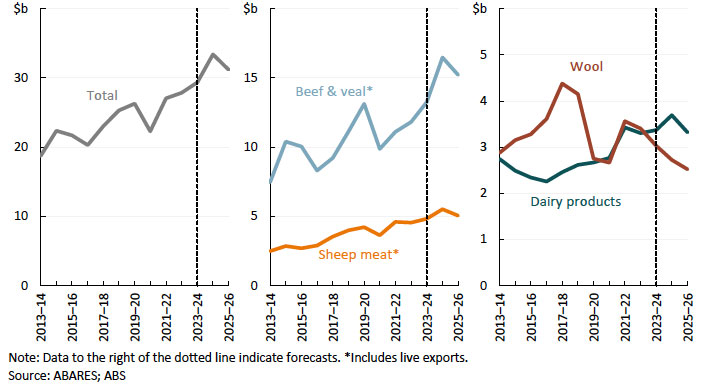

The total agricultural export value is forecast to fall by $2.6 billion to $71.7 billion in 2025-26, ($76.7 billion including fisheries and forestry exports) driven by lower livestock and livestock product export values, down $2.2 billion.

While crop export valuesare only expected to fall slightly in 2025-26, down by $0.4 billion. Despite expected falls, agricultural export values are still expected to be the third highest on record.

The value of livestock and livestock product exports is forecast to fall to $31.2 billion in 2025-26, down by 7% from 2024-25. Lower forecast export values across most livestock and livestock products reflect lower export volumes, more than offsetting higher export prices.

The forecast fall in total livestock and livestock product export values is driven by beef, veal and live cattle down by 8% to $15.2 billion, sheepmeat and live sheep down by 9% to $5.0 billion, dairy down by 10% to $3.3 billion, and wool down by 7% to $2.5 billion.

There is still hope left for producers that the value of livestock and livestock product exports for 2025-26 will increase due to higher demand for our beef, veal and live cattle, along with sheepmeat and live sheep exports, with several countries shunning US-bred produce.